Oculus Fund Investment Strategy

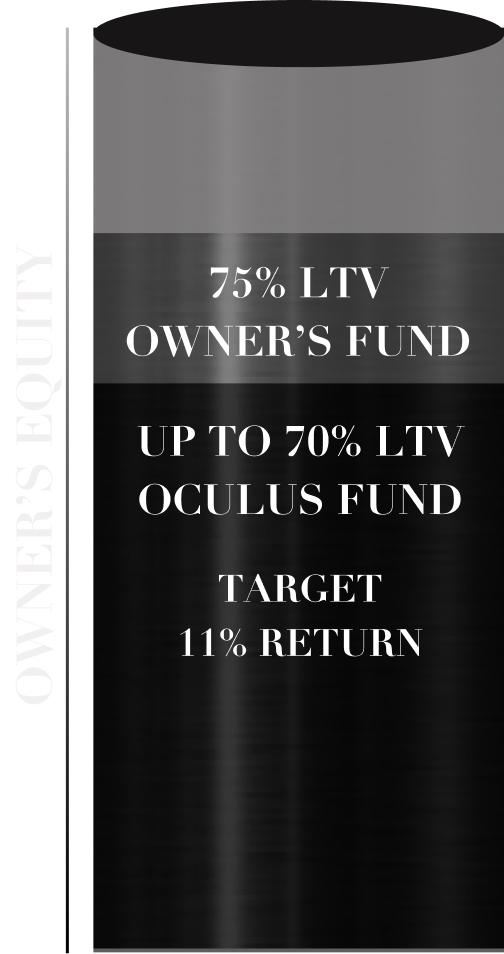

Ownership group actively participates in all mortgage transactions with their own capital behind every investor dollar. This provides a secure back-stop for all investors in the Mortgage Fund with the added security of lowering investors’ exposure.

The Owner’s Fund can elect to keep the Oculus Fund current and deals with any defaults should they occur.

We lend on value-add development, industrial, multi-family, and commercial loans within Ontario only.

We only invest in mortgages with a clear exit strategy and a strong purpose.

Tax Advantages

Efficient Tax Structures

Speak to your tax professional on the tax efficiency of this structure for you.

Individual

T5013 slips produced, reducing bookkeeping and accounting costs. Smoother investor experience.

TFSA, RRSP, RRIF, RESP Eligibility

Allows for superior returns to many other off the shelf options for your registered funds.

Corporation

T5013 slips produced, reducing bookkeeping and accounting costs. Smoother investor experience.

Tax Efficiency for Corporate Investors: Returns are taxed as active business income at a rate of 26.5% in Ontario. Your small business limit will not be impacted from this income.

Track Record & Expertise

Demonstrated expertise in rigorous underwriting. Our team has underwritten over $10 Billion of mortgages to date.

Combined hands on experience of over 30 years in the mortgage industry brokering, lending and enforcing on mortgages.

Mortgage book of $250 Million.

Risk Management

Owner’s Fund absorbs losses. Management’s capital is behind every dollar invested in the fund ensuring management’s goals are completely aligned with our investors.

The Owner’s Fund is the first to absorb any loss and the last to collect returns. This is the only fund of its kind in Canada.

Third party reports and consultants on every deal.

Loan Administration

Introduction of third party administration for a smoother investor experience.

Transparent Operations

Monthly statements and payments

Tracking and Analytics

Robust fund tracking and analytics

Team Experience and Software

Strong experience with proprietary software for the best experience